What is the future of credit decisioning?

Loan decision-making is an extremely complex task – there are so many points to consider before making the final decision! Fortunately, the latest advancements in Big Data management, process automation, and analytics create the perfect ground for effective credit decisions, doing the hard work for you.

Such tools speed up the loan processing time and drive precise outcomes for both lenders and borrowers. In contrast, legacy loan decision-making practices fail to provide such a level of efficiency and rarely please borrowers.

But which technologies make use of digital data and automation to bring the future of credit decision-making? You’ll find out right here

Benefits of modern credit decision-making software

Higher revenue

Software for loan decision-making increases a bank’s capacity to grant loans. Due to the faster and easier application processing and calculations, bankers can serve a wider range of customers. Automated decision-making allows for an increase in profits with on-point credit conditions and service availability.

Efficient lending service

Credit processing systems eliminate manual tasks and improve the overall banking software connectivity. Banks need to comply with a huge amount of service regulations and laws that require meticulous attention. It is difficult for employees to keep all these rules in mind, which sometimes causes costly mistakes. Loan processing software automates compliance routines and allows for employers to avoid problems occuring with regulators as a result of simple errors.

In addition, digitized and integrated loan decision-making apps are able to send loan data to other parts of the banking system. It facilitates cross-department communication and streamlines internal operations.

Decreased credit-loss rates

The precision of loan decision-making software reduces risks related to credit granting. Automated credit decision-making solutions allow us to make informed borrower scoring, improve KYC (Know Your Customer) processes, and present optimal credit conditions. With the right credit conditions, bankers can be assured of credit repayment success.

Convenient customer service

Credit decision-making software speeds up credit time-to-decision, so the customers don’t need to wait for loan approval for weeks. Also, the system allows the customer to get the loan when they want and where they want. It means that they can submit an application online, get a notification of the decision, and get the money on their card without ever visiting the bank. Additionally, credit decision-making systems help banks to develop optimal credit margins and repayment time for the customer.

How automated credit decision-making works?

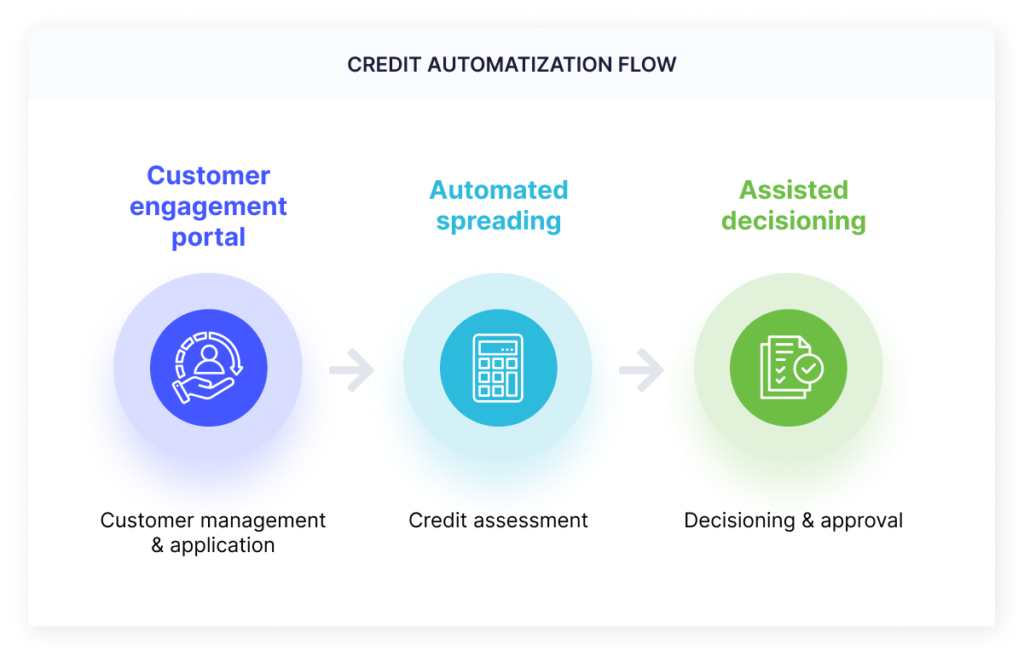

Credit decision automation software now works in several stages. Each stage involves a particular set of software that allows digitizing loan granting services.

Credit decision-making starts with receiving the application. Today, banks get applications from their web customers’ portals or mobile banking applications. Then, the decision-making system analyzes the application conditions against the bank’s rules and allocates it to a corresponding department within the bank. The allocation rules depend on the type of borrower (individual, enterprise-level customer, etc.) and the purposes of the loan.

When the application gets to the right credit basket, the decision-making system evokes customer data from internal and external sources for analysis. At this stage, the system checks the borrowers’ credit history, demographics, and other relevant metrics scripted in the credit decisioning software. On the basis of this information, the system scores the customer and notifies a department employee of the borrower’s eligibility for a loan. The deep analysis of the data is usually performed by AI/ML technologies that derive the necessary information from large chunks of data.

If the requested loan conditions for a customer are risk-free for a bank, the employee approves the credit. The approval sets off, allowing the system to send an approval letter to the customer. When the terms are accepted, the system initiates the transaction by the bank to the account of a borrower. If the decision-making system spots risky conditions, it can either deny the loan application or offer another set of loan conditions. The decision-making is supported by other technologies like AI/ML and RPA.

Credit decision automation solutions of the future

What technologies comprise a modern credit decision-making system?

Modern loan decision-making technologies work in combination to make banks’ credit strategy work. They work in all the loan decision-making stages, facilitating application submission, processing, and approval. Here are the core technologies that support the decision-making processes.

Business rules management systems

Business rules management system or BRMS is the software that drives the credit decision process. The bankers develop the rules according to their credit strategy and integrate them with the bank’s database, client-side applications, etc. The system organizes separate rules in decision trees and automates their execution. BRMS ingests the necessary data from databases and external sources and checks the borrower’s data against these rules. After the whole rule-tree execution, the BRMS gives out the final decision and notifies the employees.

Scoring engines

Scoring engines are an inseparable part of business rules management systems. It uses a set of rules to evaluate the borrower and define the borrower’s eligibility for certain credit conditions. The borrower scoring relies on the customer’s credit history, demographics, and other metrics. For instance, a borrower gets a high score if he or she has an impeccable repayment history, a decent level of income, and property that can grant the security of the loan. With the scoring engines in place, bank employees get rid of paperwork and hours of customer analytics.

Artificial Intelligence and Machine Learning

AI enhances the processes in BRMS and scoring systems. The technology performs data analysis, and calculation, and facilitates credit model execution across the credit decision-making system. With AI-supported loan automation solutions, banks are able to create profitable conditions faster. At the same time, ML (Machine Learning) allows banks to continue improving their credit models. The technology takes into account the success rates of credit repayment and allows AI to develop more effective strategies for the future.

Robotic Process Automation (RPA)

RPA is also a supportive technology that has to do with lending automation. It automates repetitive tasks and executes the processes following the decision outcomes. In addition, RPA technology enhances regulation compliance allowing the structure of the automated services in line with governmental requirements.

Low-code platforms for credit decision-making system development

The low-code approach is the game changer for banking software development. Low-code platforms allow financial organizations to develop loan processing solutions faster and reduce development costs. The effectiveness of low-code development is defined by several aspects:

Visual development

Low-code platforms use the ready-made parts of code expressed as graphic components. To create an app, the users need to drag and drop the components into the development environment and set the parameters for each component. In relation to credit decisions, low-code platforms for banking software development offer the ready-made infrastructure for BRMS and scoring solutions development. Eventually, the business rules management systems development boils down to choosing the necessary parts of code and defining the rules.

Customization capacity

In contrast to no-code platforms, low-code platforms give bankers the space for decision-making software customization. Manual coding on low-code platforms still requires professional developers’ input. However, the level of developers’ expertise can be lower due to the low-code’s productivity features like automated testing, IDE (Integrated Development Environment), AI-assisted development process, reversible app development feature, and fast deployment.

Availability for citizen developers

Due to the ease of use and app management with low-code platforms, regular banking employees can develop and adjust the rules without professional developers. After a quick low-code training session (or several easy-to-digest sessions), domain experts can implement credit decision-making models to set the parameters of custom components.

Security

Low-code platform providers are responsible for the security and stability of decision solutions. They use multiple practices to ensure the safety of operations in their systems with AI fraud detection, 2-factor authentication models, and role-based access rules. Low-code decision-making systems comply with multiple banking software security regulations such as ISO27001.

Join the future of credit decision-making with ProcessMIX

Start your credit decision system development with the ProcessMIX free demo. ProcessMIX is the back-end low-code development platform for banking software development. It has a ready-made infrastructure for credit decision-making solution development and allows users to customize it as much as users need. You can easily integrate the ProcessMIX loan processing automation system with multiple data sources and other bank applications.

ProcessMIX employs AI/ML and PRA to execute the rules, analyze data from multiple sources, and improve borrower scoring. Several enterprise-level banks have already benefited from ProcessMIX credit decision-making automation solutions. Check our case studies to see how they did it.

Visual Development

Visual Development Assignment of risk level and customer category within KYC processes at customer onboarding

Assignment of risk level and customer category within KYC processes at customer onboarding Cross-Sell Offer Calculation for the 12M Client Base

Cross-Sell Offer Calculation for the 12M Client Base