Automation of Suspicious Transactions Identification According to AML/CFT Requirements

3x faster

2.5x less

100%

60%95%

2x less

3x higher

Issue:

The Bank’s software for identifying suspicious AML/CFT transactions had the following shortcomings:

- Insufficient coverage of suspicious transaction criteria checks (only around 60% of criteria)

- No provision for a 360-degree view of the analysis data to the team (e.g., risk and profile of the client (KYC)) during transactions analysis, which required additional labor costs.

- A need for more flexibility. It was not possible to expand or change the settings and parameters for detecting suspicious operations without involvement of IT specialists or software updates.

As a result, Compliance Officers spent excessive time on routine processes to ensure AML/CFT compliance. Manual analysis procedures required the involvement of other departments’ staff. At the same time, more complex and non-standard money laundering schemes were not always detected in a timely manner.

Goal:

The Bank instructed the ProcessMIX team to detect the following transaction types for further detailed analysis:

- if a participant in a financial transaction or its beneficiary is included in sanctions or terrorist lists, or an organization whose beneficial owner is an individual included in such lists;

- if a participant in a financial transaction is registered, has a place of residence or location in a state (territory) that does not participate in international cooperation in the field of AML/CFT, or does not comply with recommendations of the FATF, as well as if financial transactions are carried out using an account in a bank registered in such a state;

- if the financial transaction is suspected of being related to the receipt and (or) legalization of proceeds from crime, financing terrorist activities, proliferation or financing the proliferation of weapons of mass destruction;

- transactions that do not correspond to the client’s activity goals, established by respective constituent documents, types, and (or) nature of a client’s activity;

- transactions repeatedly carried out by a participant in a financial transaction in order to evade registration in a special form;

- if the amount of a financial transaction is equal to or exceeds established thresholds, and at the same time refers to one of the following types of financial transactions: a financial transaction with cash; financial transactions with movable and immovable property; financial transactions with securities; financial transaction on loans; financial transaction for the transfer of debt and assignment of claims.

Solution:

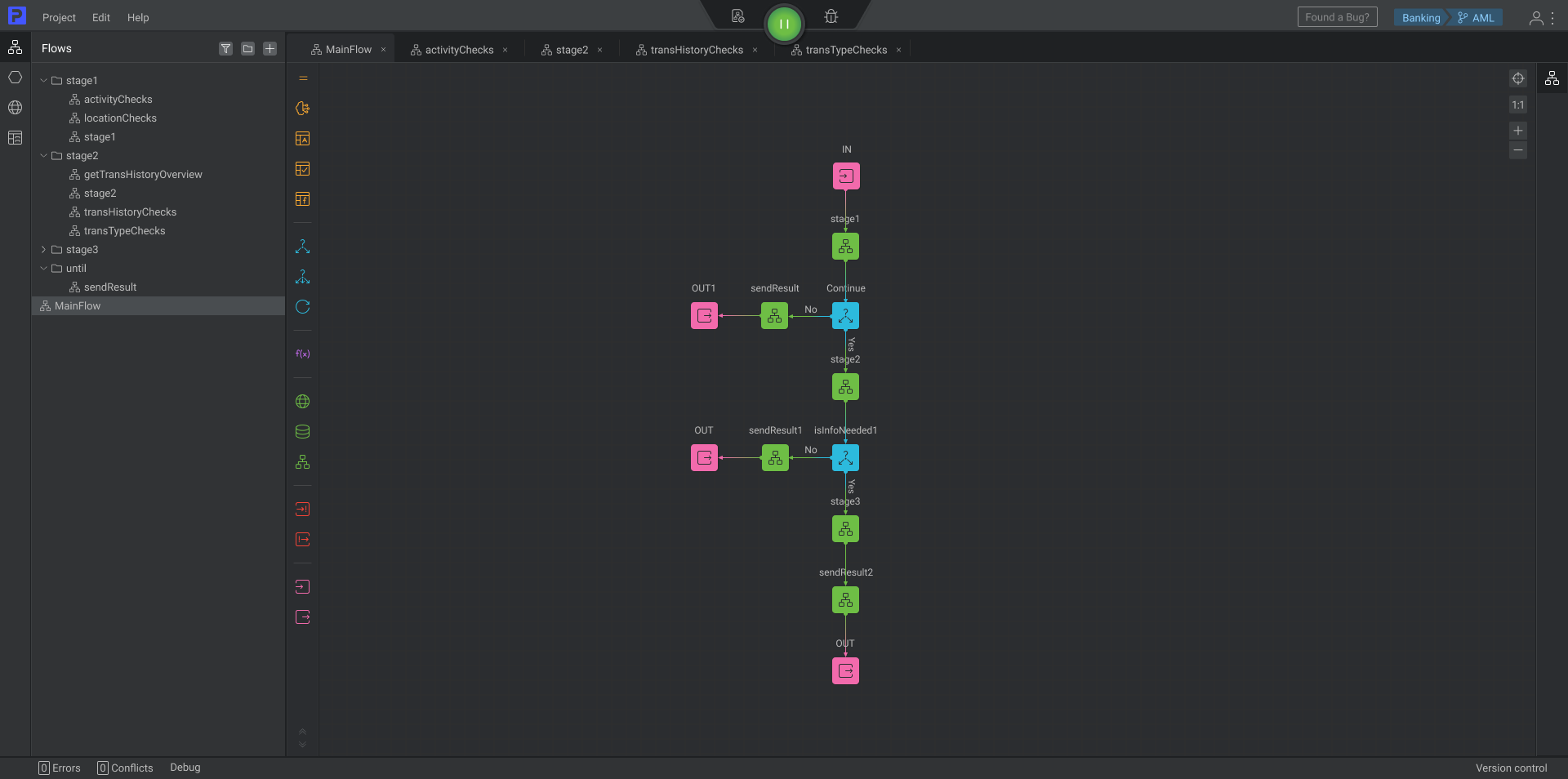

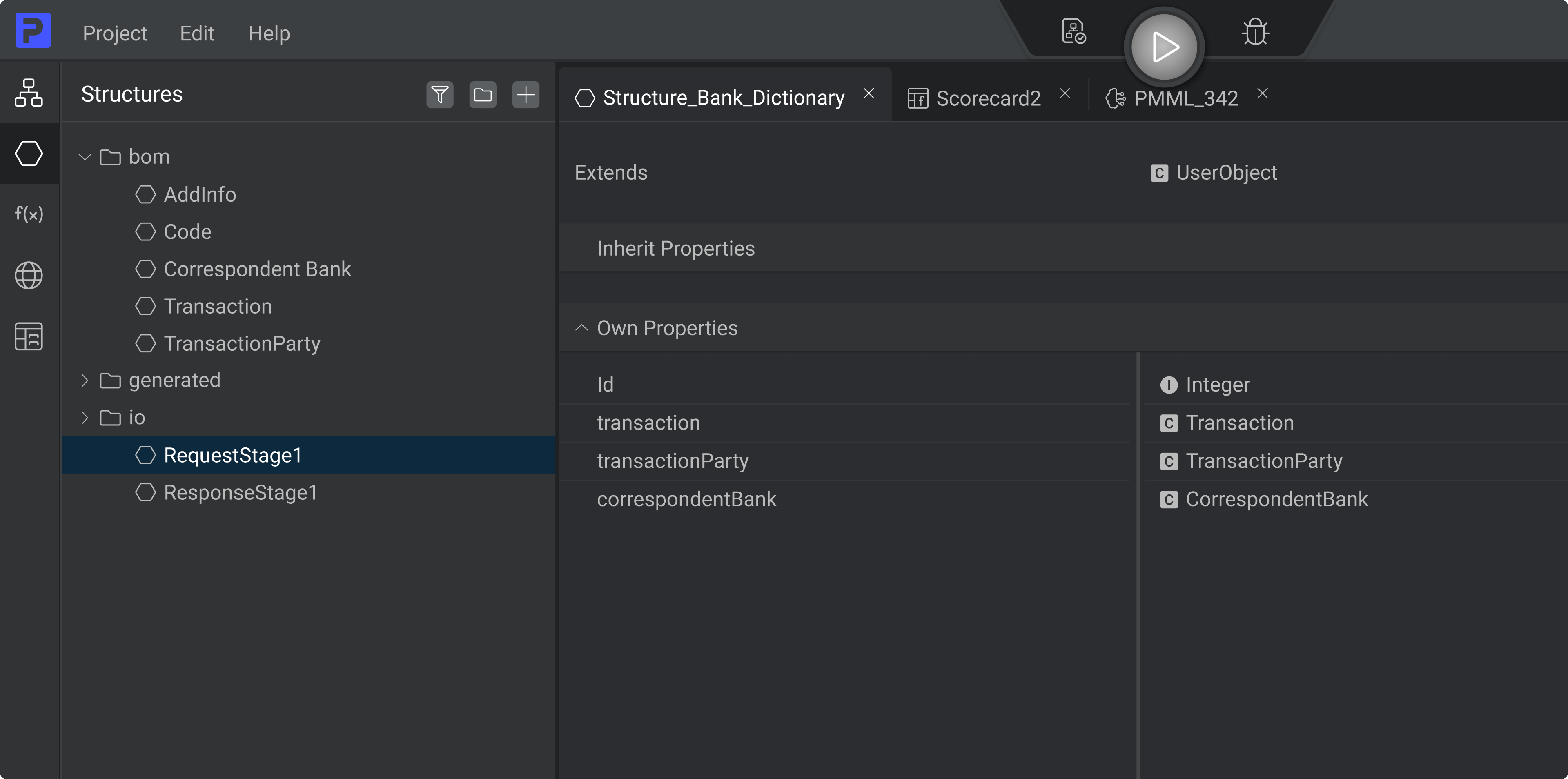

When working on the project, the ProcessMIX team first compiled the necessary data model and identified data sources for analysis.

ProcessMIX needed to be integrated with the core banking system, processing, KYC/CRM system, compliance officers’ work interface, and DWH of the Bank to ensure the required depth of analysis. Two-way integration between ProcessMIX and the Bank’s systems was required: ProcessMIX receives data for analysis and identification of suspicious transactions; depending on the results of the analysis, sends the required results and/or instructions and suggestions for further actions with the transaction and/or client to the proper Bank systems.

The settings for identifying suspicious transaction criteria in ProcessMIX ranged from the most simple and common to more complex and rare.

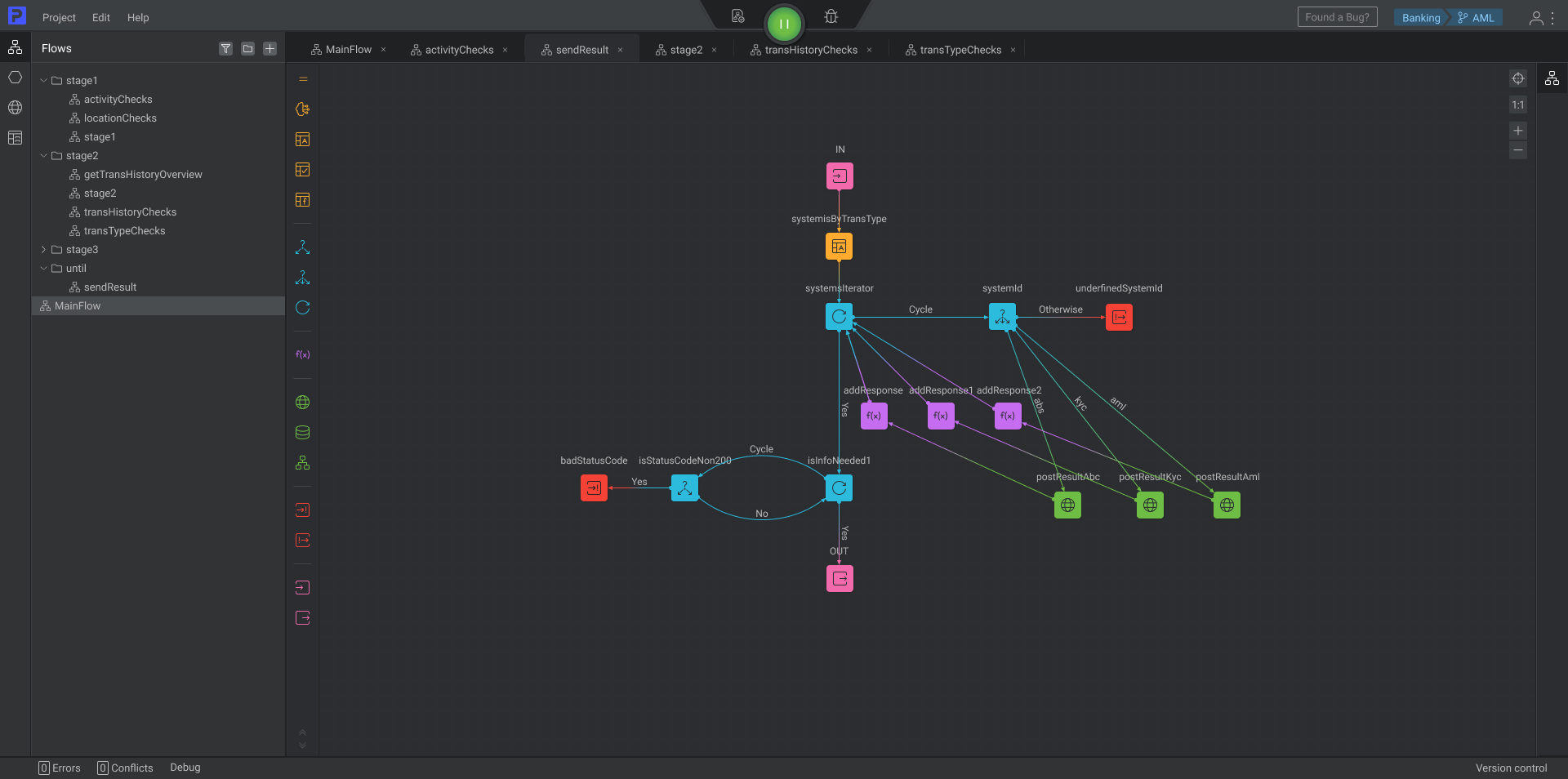

ProcessMIX in action

- transaction initiating software transfers transaction data to ProcessMIX (transaction nature, amount, details, counterparties etc.);

- after primary data analysis, ProcessMIX determines whether a final decision can be made or whether additional data is needed. Depending on analysis results, ProcessMIX either initiates termination of analysis or sends an additional data request from internal systems storing the required data (e.g., affiliated parties’ details, payer’s previous transactions, etc.);

- if necessary, the second stage of analysis is performed. If a final decision is still not possible, ProcessMIX initiates a request for data from external resources. If a final decision is made, ProcessMIX initiates process termination;

- in the third stage of the analysis, the final decision is made.

Summary:

3x faster

2.5x less

100%

60%95%

2x less

3x higher

As a result of the ProcessMIX solution’s implementation, the requirements of the Bank were fully met:

- the variety of ProcessMIX data analysis tools made it possible to fully automate the identification of suspicious transactions criteria and to apply more complex models to analyze possible non-standard money laundering schemes. Also, ProcessMIX AI models have allowed the bank’s staff to identify new ways of circumventing legal requirements and draw the Bank’s attention to them in a timely manner;

- the quality of data analysis has increased significantly, which almost completely freed the Compliance officers from routine processes. Currently, their attention is required only in truly complex non-standard cases;

- changing existing settings and adding new suspicious transactions criteria is carried out without the involvement of IT specialists. At the same time, the convenient ProcessMIX interface allows users to make all the necessary changes as quickly as possible;

- The ProcessMIX software covered 95% of signs of suspicious transactions;

- implementation of ProcessMIX, including integration with the existing systems of the Bank and setting up the detection of main suspicious transactions criteria, and took 4 weeks.

Moreover, ProcessMIX features allowed the Bank to engage with Compliance Officers of various levels depending on the client/transaction characteristics.

Visual Development

Visual Development Assignment of risk level and customer category within KYC processes at customer onboarding

Assignment of risk level and customer category within KYC processes at customer onboarding Cross-Sell Offer Calculation for the 12M Client Base

Cross-Sell Offer Calculation for the 12M Client Base